Here are the 33 YC-Backed Startups Raising on Wefunder Now (Part 2 of 3)

Y-Combinator and WeFunder teamed up to offer retail investors a fascinating list of startup deals to invest in. We looked at all of them.

This is Part 2 (pronounced “deux”) of our Wefunder-YC roundup. Part 1 (pronounced “one”) is here. As we mentioned before, some of the campaigns may now be sold out or closed. That’s what you get for sleepin’.

What is it? Unschool is an education tech startup in India that offers alternatives to traditional professional schools, also known as vocational education. Students can sign up for pre-recorded classes, take on projects, and receive placement assistance upon completion.

What’s the opportunity? This area within ed-tech is surging. There are numerous well-funded startups offering education alternatives. These companies are addressing long-standing issues in the education systems: Colleges and universities are struggling to justify their tuition and traditional vocational schools are often outdated to modern workforce trends. The market is not only recent grade school graduates, but experienced professionals looking to upskill.

How’s it going so far? Unschool is approaching a $700,000 annualized run rate. The company believes its created a better model than competition, citing a 40% completion rate versus an average 3% completion rate for online courses. The company is profitable and is raising a fresh round of financing to expand operations.

Terms: SAFE with a $15 million cap.

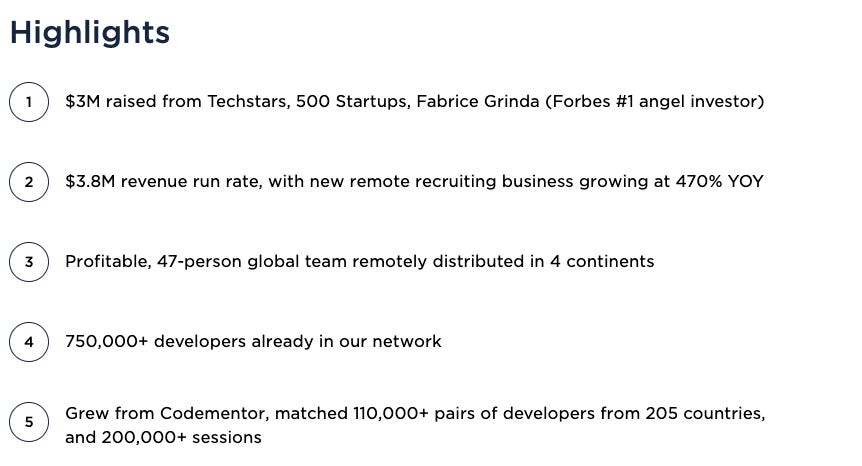

What is it? Arc is a platform for developers to find remote work opportunities. The company connects job seekers with hirers, assesses technical skills, and provides a community to share tips and troubleshoot.

What’s the opportunity? Of the many things COVID taught us, remote work has proven itself to be a viable (and in some cases superior) alternative to location-based workplaces. Arc focuses specifically on pairing talented developers with companies that need quality remote workers.

How’s it going so far? Arc is off to a great start. In 18 months, the company is approaching a $4 million annualized run rate and has the backing of several top tier investors. In addition to Y Combinator, Arc received investment from 500 Startups and notable angels including Brad Feld and Fabrice Grinda. It helped that Arc was born out of Codementor, one of the largest coding mentorship sites in the world with a developer base of more than 750,000.

Terms: SAFE with a $32 million cap.

What is it? Bluelight aggregates financial data for startups and investors and digests it into valuable insights, such as benchmarks, performance metrics like customer acquisition costs and lifetime value, and business-wide data harmonization.

What’s the opportunity? Small businesses have a variety of software-based tools to help them run efficiently - think Quickbooks, Salesforce, Gusto, etc. The problem is that these tools require individual monitoring and a lot of repeat work (we know from experience.) Bluelight plans to offer customers a single, company-wide view of financial-related information and generate valuable insights from the raw data.

How’s it going so far? Bluelight just launched its beta in the past month and claims to have 10 paying customers. The company is definitely in the top of the first inning, but the concept makes a lot of sense and the insights, if as described, would prove valuable for millions of startups and small businesses. The Bluelight team is made up of a former corporate VC, an engineer, and a product guy. We like that mix.

Terms: SAFE with a $12 million cap.

What is it? Leah Labs is using gene therapy to fight cancer in dogs. The company uses CAR-T cell therapy, which is already used in humans, to enable dogs’ cells to fight off deadly cancers.

What’s the opportunity? Current canine cancer treatments are very expensive and more about life-extension than curing disease. There are about 90 million dogs in the United States and one third of dogs die from cancer. At a high level, that’s around 30 million potential patients per year, if the therapies prove effective. Like any biotech, it’s a big swing at a big problem, but if it works it has tremendous potential.

How’s it going so far? Leah Labs has been at this for a while. The company has received nearly $400,000 in grants and previously raised nearly $500,000 on Wefunder (2019). The technology is currently in a safety study, which is the precursor to a true clinical study with dogs.

Terms: SAFE with a $12 million cap.

What is it? InnaMed allows people to receive blood tests from a device in the comfort of their own home. The device also allows digital healthcare providers to interface with patients with video and easy access to medical data.

What’s the opportunity? While this may sound eerily familiar to some, the promise to disrupt healthcare with fast, affordable blood test technology is captivating. Enabling patients to test their blood at home would yield significant improvements in managing chronic illnesses as healthcare providers could see constantly-updated data, tweak medications, and make further decisions that improve patient outcomes and drastically lower cost of care.

How’s it going so far? InnaMed has 9 patents on its proprietary hardware and processes. The blood test cartridges purportedly deliver results in as few as 10 minutes. The IoT device then sends the blood test data to the healthcare provider in an e-report. The company plans to first sell the devices to pharmaceutical companies for purposes of clinical trials, and eventually incorporate the devices into standard care. InnaMed’s next steps are to complete a pilot run of the devices, build the team, and work towards FDA clearance.

Terms: SAFE with a $25 million cap.

What is it? Signoz is an open source monitoring platform for companies’ enterprise applications. For those of you who aren’t sure what that last sentence means (🙋), think of the gauges in your car’s dashboard - they’re telling you how the machine is running and if any alarms are going off.

What’s the opportunity? There are lots of closed solutions for monitoring and tracing, but Signoz takes an open approach that allows developers to customize their monitoring, tracing, and correlation features. The broad shift to open-source solutions is evident among many industries, and this is no different. Companies increasingly prefer open-source systems for security and customization purposes. Signoz tries to deliver the best of both worlds by giving developers an easy-to-use solution that can be tailored to a wide range of applications and protects privacy.

How’s it going so far? The company launched one month ago and, according to management, has 4 large companies actively testing its technology. Signoz’s goal is to hit a $1 million annualized run rate within 24 months.

Terms: SAFE with a $10 million cap.

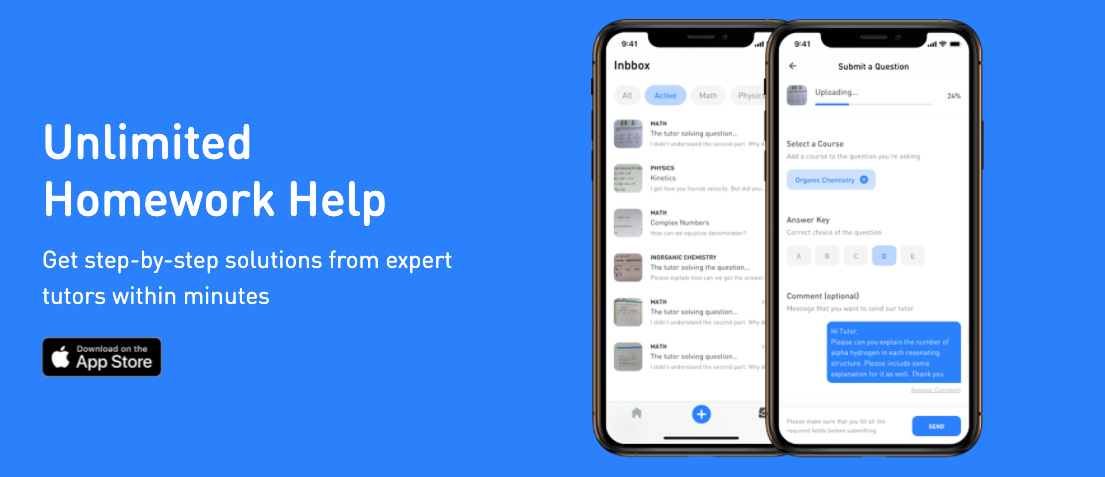

What is it? Kunduz is a personalized tutoring app that allows students to get affordable, on demand help. Students can take a picture of a problem from their phone, send it to Kunduz, and the app finds a tutor who can answer it within minutes. Where was this when we were growing up?

What’s the opportunity? Parents no longer have to pretend to understand their kids’ homework questions! Kidding. The opportunity is huge - $30 billion according to management’s TAM analysis for the U.S., India, and Turkey. Accessible, affordable tutoring evens the playing field for students from all backgrounds. The company’s solution is beautifully simple - answering an army of tutors answering question by question, which lays the foundation for a library of problems and solutions that can then be used via AI to automate the process in the future. Kunduz says its tutoring solution is ten times faster and cheaper than existing options.

How’s it going so far? Kunduz is running strong with more than $300,000 in monthly revenue. Thousands of students send questions to a network of more than 35,000 tutors for instant answers. Students pay a monthly subscription fee for access, and tutors make money for each answer they give. Now, the company is focused on improving its AI engine, which saves the company money while making the product even better for users.

Terms: SAFE with a $45 million cap.

What is it? Gigs Live is a subscription platform for video-based creators. Think a Substack (like what we’re using right now), but for video instead of words.

What’s the opportunity? The creator economy is on! Instead of intermediaries and toll-takers, creatives can now forge direct relationships with consumers via self-publishing platforms. On Gigs Live, creators can sell subscriptions, pay-per-view tickets, merch, and one-offs like meet-and-greets directly to their fans. The company makes the content available on its site or on consumers’ platform of choice, like Apple TV or Roku. Gigs Live believes the near $20 billion live events industry in the U.S. and $33 billion global industry are the potential markets for its services.

How’s it going so far? Gigs Live has processed $74,000 in gross merchandise value (what creators charge to consumers) in its four month since launch. The company has sold 11,000 “tickets” to its events and shows consumers spending an average of 92 minutes per session! Now, the company wants to tweak its business model to focus on advertising and third party content distribution and build out its AR/VR capabilities. We love the idea of throwing on some VR goggles and hanging out with the Stones!

Terms: SAFE with a $15 million cap.

What is it? Topkey is a marketplace that connects investment property owners with property managers.

What’s the opportunity? There are 29 million investment properties out there representing $100 billion in value. Topkey sees investors losing money on the time and effort spent on property management. If the company can become the marketplace for matching the two parties, there are tons of opportunities for add-on services like lending and insurance. Topkey currently charges managers a percentage of the contract closed on the platform and doesn’t charge the property owner anything.

How’s it going so far? Topkey signed up 50 property managers and partnered with a large residential brokerage in its first 8 weeks since launch. The team couldn’t be better - CEO Jonathan Sukhia’s former gig was Head of Management Company Partnerships at AirBnB. Co-founder Tom Patton was formerly Head of Business Development at Hotel Tonight. To call this a natural next step for these two is the understatement of the day.

Terms: SAFE with a $15 million cap.

What is it? Todos Comemos sells recipe-based prepared ingredients to consumers in Latin America. Similar to HelloFresh or Blue Apron, but the ingredients are precooked.

What’s the opportunity? Consumers are cooking at home and ordering in. The former requires time and know-how, the latter is really expensive. Todos Comemos tries to split the difference by sending ready-to-eat ingredients for final assembly to customer’s homes. In its target markets, Todos Comemos sees 160 million high and mid-income families, assumes that their offerings could replace 20% of grocery spend, and assigns a take of $2 per meal. The company is able to keep costs down by acting as an intermediary between ingredient suppliers and customers - Todos Comemos does not source the ingredients themselves.

How’s it going so far? With $500,000 in funds raised so far, Todos Comemos is proving its concept in Mexico City and Bogota. The company’s early adopters are spending $25 per week, accounting for about 20% of their grocery spend. Todos Comemos has backing from high profile angels, including Twitch’s co-founder.

Terms: SAFE with a $15 million cap.

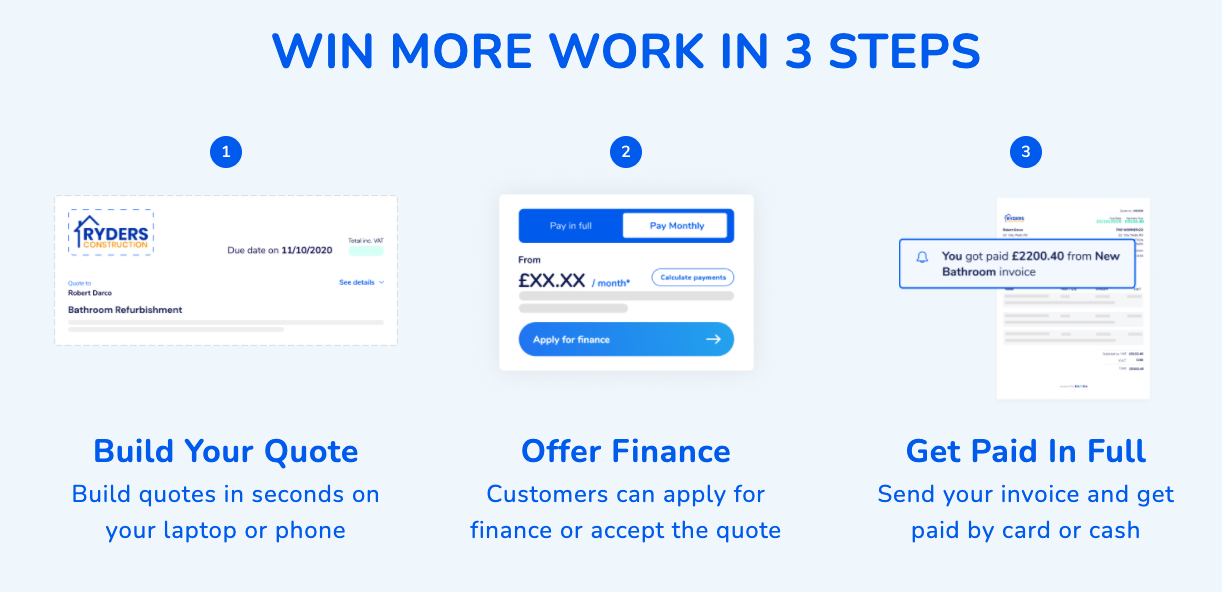

What is it? Kanda is a European startup that allows small and medium-sized general contractors to offer financing to their customers.

What’s the opportunity? Similar to what Affirm did for retail, Kanda wants to expand business for general contractors and make services more accessible to customers that may not have the cash to pay upfront. Currently, small and medium sized contractors don’t have the infrastructure set up to offer financing to customers. If they do, it’s often timely and costly to set up, making the option unappealing to both parties. Kanda can be set up within one day and can accommodate contractors of all sizes. The company makes its money by charging a subscription fee for the platform and a commission on the financing itself.

How’s it going so far? Kanda is live and gaining customers with $9,000 monthly revenue and recently secured a $5 million debt facility to allow its contractor customers to offer interest-free financing. The company is raising additional capital to improve its product and expand operations in hopes of achieving a $100,000 monthly revenue run rate over the next 18 months.

Terms: SAFE with a $12 million cap.

That’s it for today. Stay tuned for PART TROIS!

Disclosure: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

If you liked this newsletter and haven’t yet subscribed, hit the button below. It’s free, so c’mon.

If you liked this newsletter and are already subscribed, we’d be forever indebted if you shared it with your friends and colleagues. Actually, we won’t be forever indebted, but we will think highly of you.

If you didn’t like it, we’d love to know how we can make it better. Send your thoughts to feedback@capvee.com.