A special welcome to CAPVEE’s new subscribers. Thanks for joining. We’re growing our community one enlightened investor at a time, so please share with your friends and colleagues. - Michael

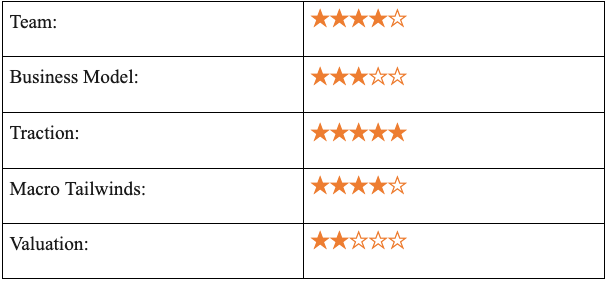

Summary:

Company: Lora DiCarlo

Sector: Consumer Goods (Sex Toys)

Platform: Republic

Minimum Investment: $100

Investment Structure: SAFE ($40 million valuation cap with 10% discount)

Funding Status: >$0.5 million ($1.1 million target)

CAPVEE Call: Buy (>4x Return Potential)

Overview

Lora DiCarlo is a woman-led start-up determined to disrupt the sex toy industry.

Lora Haddock DiCarlo founded the company in 2017 after a “life-changing blended orgasm”, which ignited her journey to develop new technologies to enhance human sexual interaction.

The company spent two years in a research partnership with Oregon State University before launching its first sex toy - flagship product Osé - in January 2020. Since launch, the company has generated significant traction going from $0 to $7.5 million in sales in 1 year and growing from a single product company to a global, multi-product and multi-channel brand.

Lora DiCarlo has raised $7+ million from many well-known investors including Republic Labs, Romulus Capital, River Bend Capital, VU Fund, and Gaingels, as well as individual investor and model, actress, and activist Cara Delevingne, who acts as brand ambassador and creative advisor.

The Problem Lora DiCarlo Solves

The sexual health and wellness industry is highly fragmented, composed of a plethora of companies and brands. Yet, within this large market, there is limited focus on design by and for women.

Lora DiCarlo products use advanced technology to mimic human touch and movements and focuses its brand messaging on female empowerment and sexual wellness. The company also offers women’s counseling services via its website.

The Team

Lora DiCarlo, Founder & CEO: Lora is a first-time entrepreneur. She previously attended Norwich University on a full-ride NROTC Officer Scholarship which she voluntarily relinquished due to family distress and worked as a medical administrator. Lora founded Lora DiCarlo in 2017 with the mission of creating “a more sexually equitable world.” She has done a fantastic job building her business and she has managed to assemble a fantastic team around herself.

Doug Layman, COO: Doug has 30+ years of experience in engineering, business operations, and as a serial entrepreneur with multiple successful exits.

Doug has a BS in Engineering from Oregon State University and an MBA from Georgetown.

Jason Moyer, CFO: Jason has 25+ years of experience in strategy, finance, venture development and M&A, including various senior roles in executive management as President, COO, and CFO. His exposure spans hundreds of companies ranging from startup to Fortune 500 organizations.

What We Like

- Lora DiCarlo’s TAM is huge and rapidly growing. According to Grand View Research, the global sex toy market is projected to grow at an 8% CAGR (compound annual growth rate) from $34 billion in 2020 to $52 billion in 2028. The growth is driven by a growing interest towards experimenting with sexual wellness, and the liberalization of social media and pop culture influences that have resulted in increasing awareness about sexual health. The company’s SAM - which includes the female segment only - is expected to grow in-line with the overall market from $20 billion in 2020 to $31 billion in 2028.

- The sex toy market is recession-proof. The ongoing COVID-19 pandemic forced people worldwide to stay indoors or self-isolate at home and practice self-care, including self-pleasure. This led to an increase in the sales of sex toys of 26% from 2019 to 2020. In other words, this is an opportunity to invest in a stable and growing - yet countercyclical - market, which adds a nice element of diversification to your portfolio!

- The sex toy industry is ripe for innovation. The sex toy industry hasn't truly innovated in a long time, despite releasing an abundance of new sex toys every year. We therefore find that Lora DiCarlo’s technology-based innovation presents a USP. Before the company launched its first product in January 2020, it spent two years in a research partnership with Oregon State University developing new technologies to enhance human sexual interaction. Together with the company’s focus on female empowerment and sexual wellness, we think that the team will be able to carve-out a profitable niche in the highly competitive sex toy’s market.

- As we all know, the proof is in the pudding. It’s good to see that the company’s value proposition has gained significant traction. To go from $0 to $7.5 million in sales in one year doesn't just happen — Lora DiCarlo is crushin’ it! The company generated a gross profit of 67% in its first year of operations, which is impressive as we would expect a gross profit margin of 40-60% for a consumer goods company.

- Lora DiCarlo has raised money from well-known investors including Republic Labs, Romulus Capital, River Bend Capital, VU Fund, and Gaingels which suggests that the team and the business model have been properly vetted.

What Makes Us Nervous

- It’s not clear if Lora DiCarlo’s initial traction has been driven by superior product quality or skilled advertising. Product reviews on Amazon are a mixed-bag, ranging between 3 to 4 stars. Jess Joho of Mashable wrote an in-depth analysis of Lora DiCarlo’s products with a middling bottom line. She appreciates the technological advances and innovative design, but finds that the products have a steep learning curve and are prohibitively expensive. As an investor, it will be important to monitor future product iterations, as innovation is critical for a hardware company to maintain sales growth and relevance.

The Investment

The company offers investors a SAFE with a valuation cap of $40 million and a 10% discount. For those new to private market investing, a SAFE gives you the right to buy common stock in the company at the next financing round. Unlike a convertible note, future equity is not a loan. As such, it does not accrue interest, have a maturity date, or have a legal obligation to be paid back. You should therefore only invest in a SAFE, if you believe that the company can and will raise financing in the future, as there is no time-limit which forces the company to convert the future equity into common stock.

Here, investors are betting that the company will be worth more than $36 million in the future.

We arrive at a max valuation of $34 million, suggesting that the company’s valuation - in line with its products - is expensive. Quality has its price. Assuming that Lora DiCarlo reaches $135 million in sales in year 5 (equates to a 0.68% market share of SAM) and an EBITDA margin of 16% (3% below Playboy), a >4x return is possible.

Please refer to our valuation model for a more in-depth explanation.

As always, if you have any questions or comments regarding the model, please feel free to directly contact our valuation guru Olof on Twitter at, he is more than happy to talk shop.

The CAPVEE Call

We view Lora DiCarlo as a buy with >4x Return Potential.

Hit us up on Twitter and share your thoughts and questions:

Further Reading:

Disclosure: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.